Lessons learned from the 2017 employee compensation survey. Designing effective compensation and benefits packages are paramount in contending for the best talent in today’s competitive labor market. As the economy improves, the demand for landscape services rises, requiring an increase in skilled labor. While this news is good for businesses from a company sales prospective, it creates significant challenges when the national unemployment rate approaches full employment. It becomes a constant challenge to recruit and retain quality employees.

Best-in-class firms need to be creative in their recruiting. While company culture is extremely important in determining employee satisfaction, employees need to be compensated fairly in terms of wages, benefits and paid time off. To provide useful information for designing effective compensation programs for our industry, my firm, Turfbooks, in conjunction with Fred Haskett of the Harvest Group, the National Association of Landscape Professionals (NALP) and LM, conducted the 2017 Employee Compensation Report for the landscape industry. The full survey is due out later this year and will be available from NALP.

The objective of the 2017 Employment Compensation Survey was to:

Compare compensation levels of various job types within a landscape firm;

Compare employee benefit programs and attendance policies amongst landscape companies;

Report the data in terms of median results of the data points; and

Provide valuable information to the industry.

The employee compensation survey was conducted online in June and July 2017 for the reporting period of 2016. The study includes responses from 230 companies.

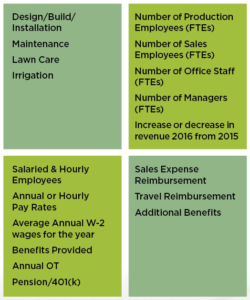

Items on the survey were worded as positive statements or direct questions and focused on landscape industry employee compensation. Areas of analysis are included in the chart below.

It’s clear that in 2017 employee compensation programs profoundly affect organizational success. The way employees perform their work is often shaped by how their total compensation system is designed, communicated and managed. What are the elements of a compensation program that is both fair and motivating?

My observations identified four key elements of a successful employee compensation arrangement.

1. The plan needs to be built to retain competent employees. Over the long term, managing a landscape company is easier when there is lower employee turnover. The wage an employee makes as well as the corporate culture of the firm can dictate the employee turnover rate. If the technician sees his work as a career as opposed to a job, he is more likely to stay and grow with the company.

2. The plan needs to provide predictable and competitive compensation compared to similar job functions at similar companies. The total compensation package needs to provide a livable paycheck week after week. In many places, landscape is seasonal. Companies that prosper can smooth out their revenue and mitigate cash flow issues created by seasonality. While many employees usually make more money in the warmer months, if they are not adequately compensated in the cooler months, they may leave your company or the industry seeking a more stable paycheck.

3. The plan gives each employee a chance to earn a higher income. Commissions and bonuses can be motivating. They need to be easily calculated by both the office staff as well as the employee himself. If an incentive program is not easy to calculate, there can be ill will.

Nothing is more demoralizing to an employee than the promise of incentives but, when starting work, finding a dysfunctional workforce and no systems in place to accurately calculate incentive-based pay programs.

4. The plan rewards for loyalty as well as technical competence. Many companies use a compensation grid that breaks their employees into a few ranks. These ranks are often attained after passing some sort of competency tests. Within the ranks, there are minimum and maximum wage rates and bonuses. As an employee moves to the next rank, he earns more.

2017 Employee Compensation Opportunities & Challenges

Understanding and comparing current compensation and benefit plans provides great insight into the industry as well as your firm and how it operates in the present. The data points contained in the survey give us a view of what’s in the rearview mirror. However, it may not be indicative of the near-term or long-term future. Just as important as the current data points are the sentiments of the key decision makers whose views of the business and industry environment will influence future compensation and benefit plans. In addition to specific questions about the company workforce, we also asked questions about participants’ outlook for the economy in general, the outlook for the industry as well as business concerns moving into the future.

Based on the responses, most agree that the economy and the industry are poised for growth. However, with growth comes challenges. Most of those surveyed feel that general economic conditions are good or excellent for the immediate short term and up to five years into the future. However, most are concerned with the labor market that seems to be tight, which makes hiring a constant challenge.

Many respondents believe that pricing and competition are or will become even more intense in the short term, and several mentioned that consolidation and mergers and acquisitions will play a significant role in shaping the future of the industry. This pressure on pricing makes it even more challenging to increase compensation programs for employees. However,

owners must be at least as generous as the competition and find the money to pay their employees. The best way to find that money is to become more efficient in all other areas of their businesses and find savings.

2017 Employee Compensation Survey Highlights

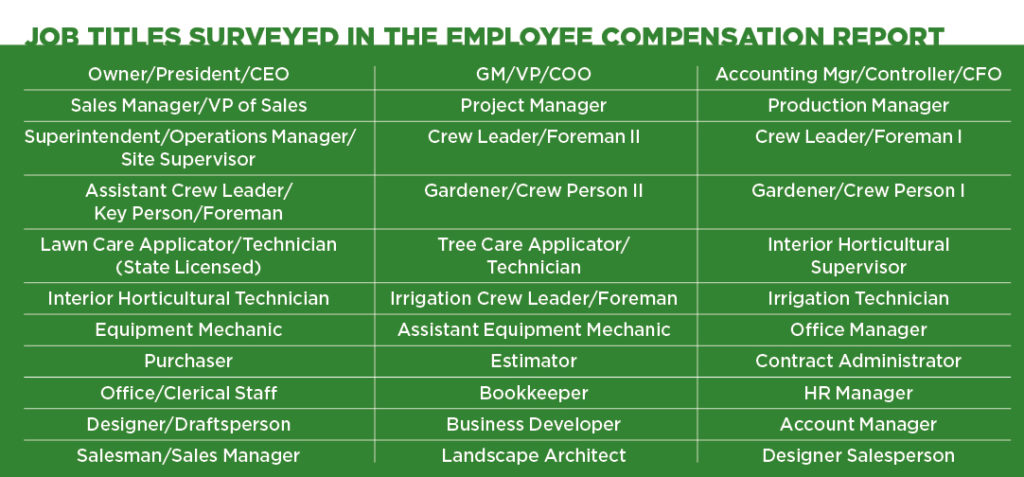

The survey looks at wages, benefits and reimbursable expenses from owner/CEO down to the laborers. Job titles surveyed are included in the chart below.

Health care benefits and costs: Health care has become a national crisis in the U.S., and under the Affordable Care Act (ACA/Obamacare), the law requires that Americans must be covered either under the employer mandate for firms who employ 50 or more full-time employees or the individual mandate for those who work for firms employing fewer than 50 employees. While those firms that employ fewer than

50 employees are not required to provide health care, they need to be able to compete with the larger companies for employees. Therefore, many smaller companies are providing a variety of health care options.

Depending on the employee’s family needs, the type and cost of health care also can be a deal breaker in terms of an individual accepting a position. Of the surveyed landscape business owners, 57 percent of their employees receive medical benefits. All companies in the survey that provide health insurance for their employees require those employees to contribute to the program. Here are some of the types of insurance offered:

- 12 percent offered traditional indemnity insurance.

- 24 percent offered a health maintenance organization (HMO) or exclusive provider organization (EPO) insurance.

- 3 percent offered point of service (POS) insurance.

- 12 percent offered a preferred provider organization (PPO) insurance.

- 6 percent offered high deductible health plan (HDHP) insurance.

On a related note, 15 percent of employees who qualified for medical benefits opted out of their employer’s plan.

Paid time off: Seventy-five percent of firms surveyed said they have a paid time off policy, including vacation, paid holidays, jury duty, personal days and military duty. Of those businesses that offer paid time off, 26 percent of them allow unused time to be carried over to the subsequent year.

Retirement plans: Retirement plans can be a great way to save taxes at the company level, motivate employees and defer employee taxes. While in most cases, traditional 401(k) plans in service firms usually result in significant restrictions on owners and managers, SIMPLE IRAs provide a method to bypass these restrictions and are relatively easy to administer. Safe harbor 401(k) plans, while requiring more administration than a SIMPLE IRA, also bypass the restriction of the traditional 401(k) and allow greater amounts to be contributed to the plan, including a potential profit-sharing component. Almost half of those companies surveyed provide some type of retirement plan for employees.

Employee Compensation Survey Takeaway: In the landscape business, our people are our product. What we sell is a service that is provided by our people who operate both in the office and out. Our people must be knowledgeable, competent and take pride in their work. The only way to employ good employees is to design a compensation program that can attract and keep them by creating a plan that motivates and rewards for a job well done.